The Wheels on the Company Car Go…

In our ever shifting modern landscape it can be hard to stay consistently abreast of small changes to rules and regulations and amendments to costs we don’t often consider (is anyone else lamenting the increasing cost of stamps and feeling like their grandmother when admitting it? No? Just us?) Occasionally, changes to important parts of our everyday lives can be implemented almost without our knowledge as they may not be widely publicised or may simply fall beneath the din of the other news of the day. Here at EcovisDCA we want to ensure that you are always aware of changes which may affect your pocket whether positively or negatively, and today we want to inform you about a change to motor travel rates for Civil Servants which may have escaped your notice as these changes have not been massively advertised.

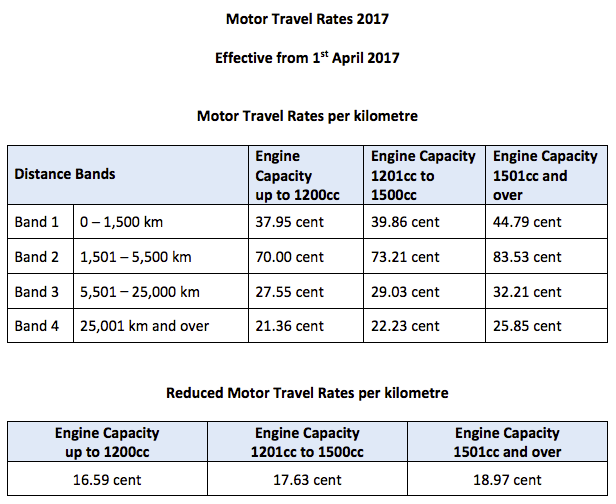

The motor travel rates for Civil Servants apply where employees use their private vehicles for business purposes. In these cases the costs can be reimbursed through the flat-rate mileage allowances which have been amended per a general review as of April 1st 2017.

- Key changes to previous arrangements include:

- Distance bands increased from 2 to 4, which may benefit workers who do a great deal of driving for business.

- Lower recoupment rate for the first 1,500km.

- Increased recoupment rate from 1,500 to 5,000km which again may benefit those who do a lot of business driving.

- More beneficial compensation rates for cars with lower engine sizes and emissions, benefitting those workers already conscious of their carbon footprint and encouraging others to be more aware.

- Changes to the mileage formula apply and rates will be locked in for a period of 3 years.

Should you require further information or guidance on how this may affect you and your business or any other business or financial issues, please don’t hesitate to contact us.

– – – – –

~ DCA PARTNERS, DECLAN DOLAN & EAMONN GARVEY